Another Jumbo Interest Rate Cut

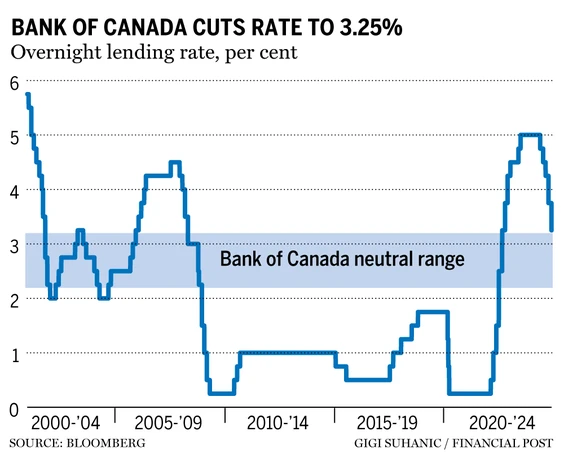

The Bank of Canada continues to take decisive action to stimulate the economy. In its December 11th announcement, the Bank lowered its overnight policy rate by 50 basis points to 3.25%, marking the second consecutive “jumbo” rate reduction. This move aims to support economic recovery and manage inflation. The overnight rate is now sitting at the high end of what the bank considers neutral for the economy and the bank states that moving forward, they will consider additional rate cuts one decision at a time. Given the trajectory of the economy and uncertainty about punitive tariffs, many experts predict there will be further cuts to come.

Enlarge Graph