Real Estate Market Conditions - Monthly Update

June and July 2025

Overview

A Steady Summer Market Takes Shape

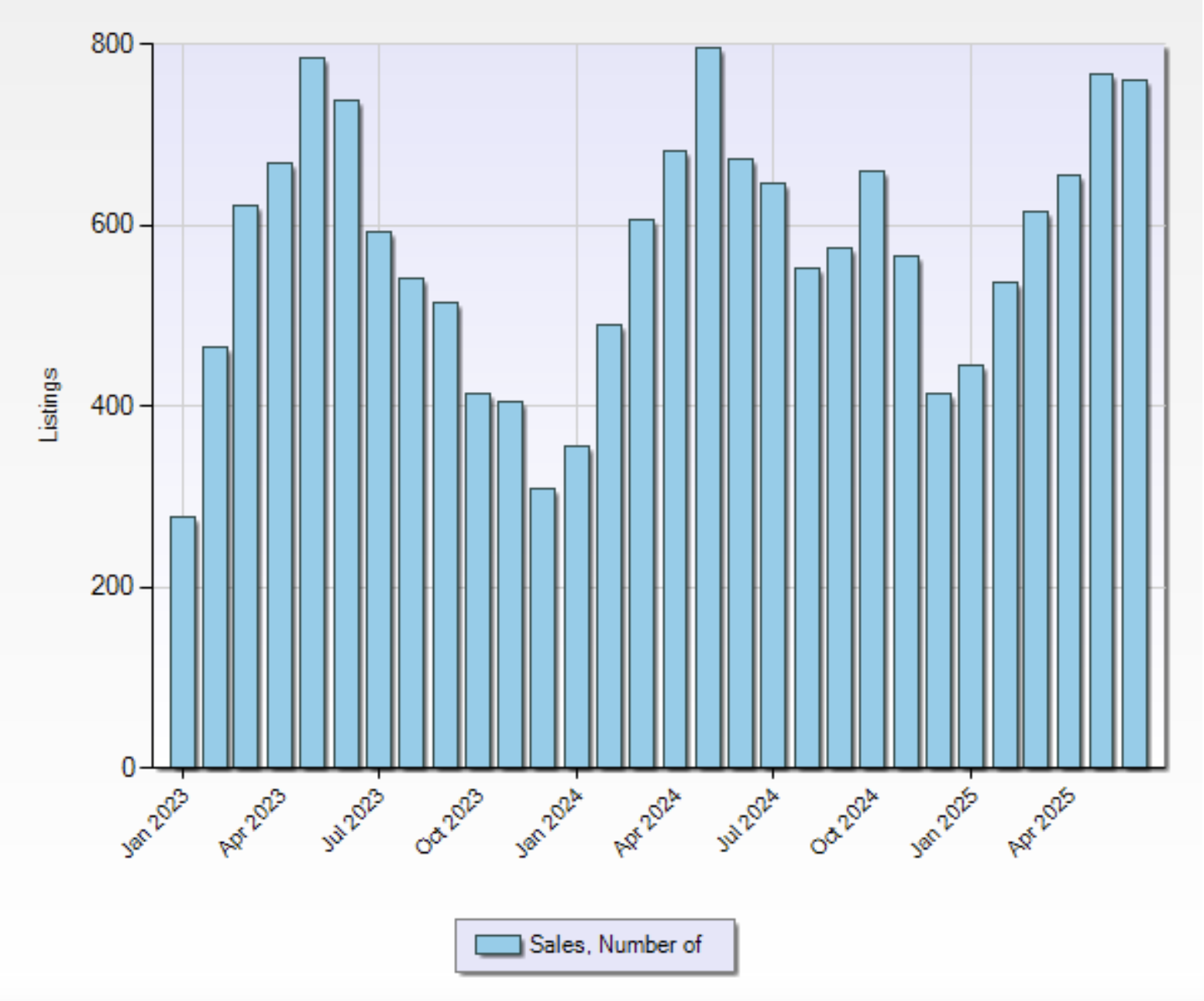

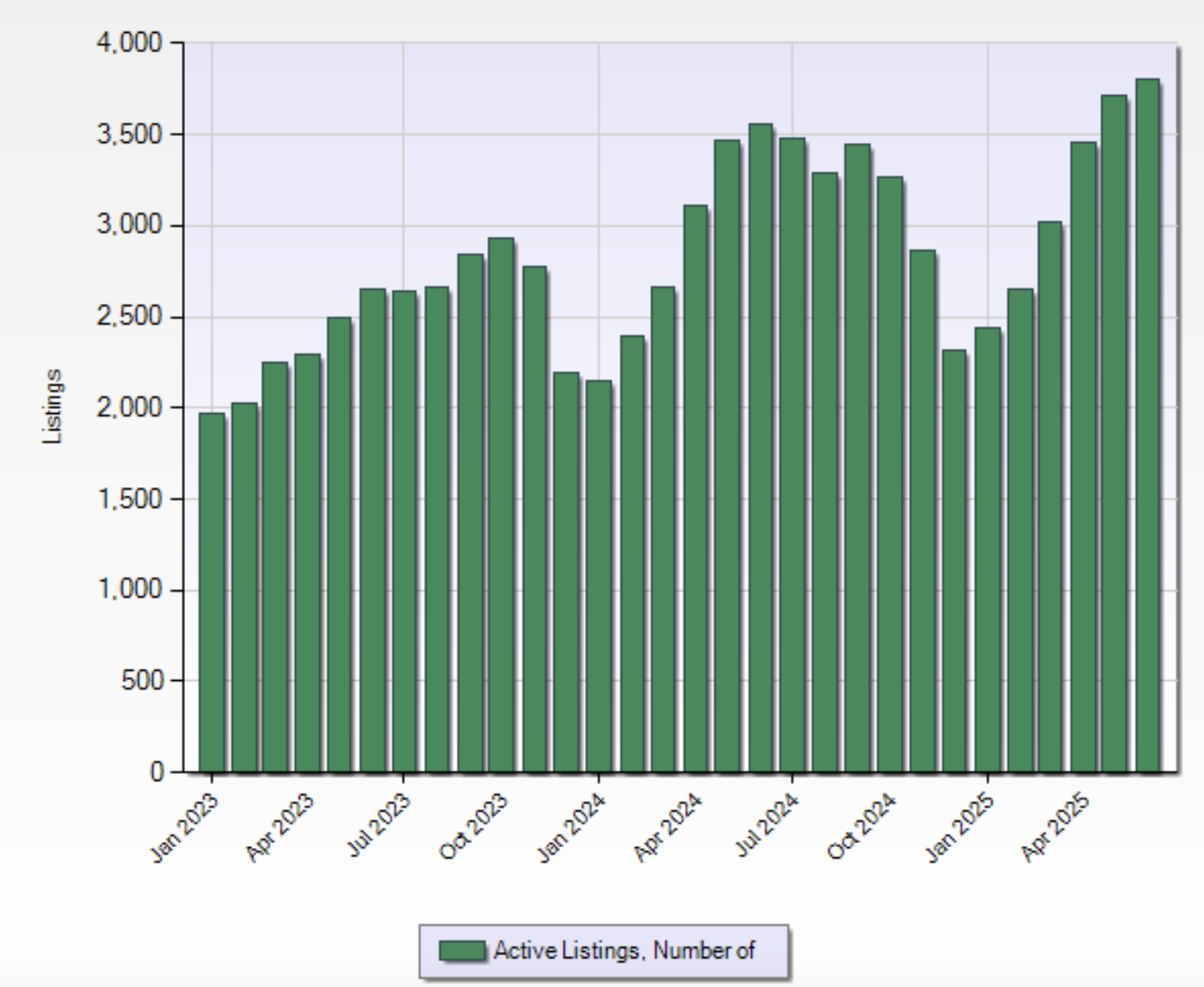

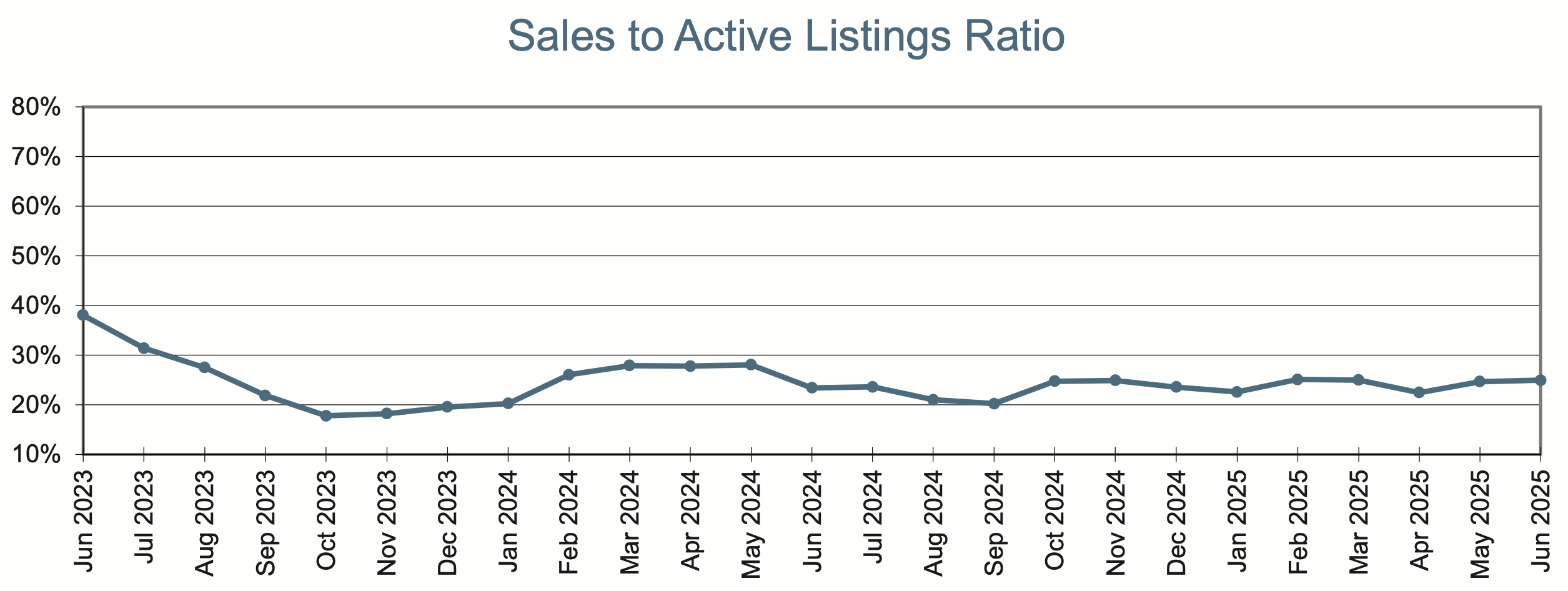

Real estate activity across Victoria and the Gulf Islands remained healthy through May and June. “We observed a fairly robust real estate market in the month of June,” said 2025 Victoria Real Estate Board Chair Dirk VanderWal. “Recent market trends suggest that we have finally transitioned from a pandemic-driven market to more conventional patterns. We have experienced consecutive months of a healthy and balanced market that includes listing inventory levels we have not seen in a decade paired with steady sales.”

With demand remaining strong, inventory improving, and prices relatively stable, the local real estate market is well-positioned for a healthy summer season. The environment continues to favour strategic decision-making from both buyers and sellers.

Summary - Opportunities for Buyers

- Inventory growth is providing more options and easing competition

- Stable, if not falling, interest rates continue to support financing opportunities

- Balanced conditions allow buyers time for careful decision making

Summary - Opportunities for Sellers

- Market activity remains brisk, especially for well-presented and well-priced homes

- Prices are stable, if not increasing, despite the global economic uncertainties

- Balanced conditions are allowing sellers to plan with greater certainty