Real Estate Market Conditions - Monthly Update

November 2024

Market Recovery Takes Shape

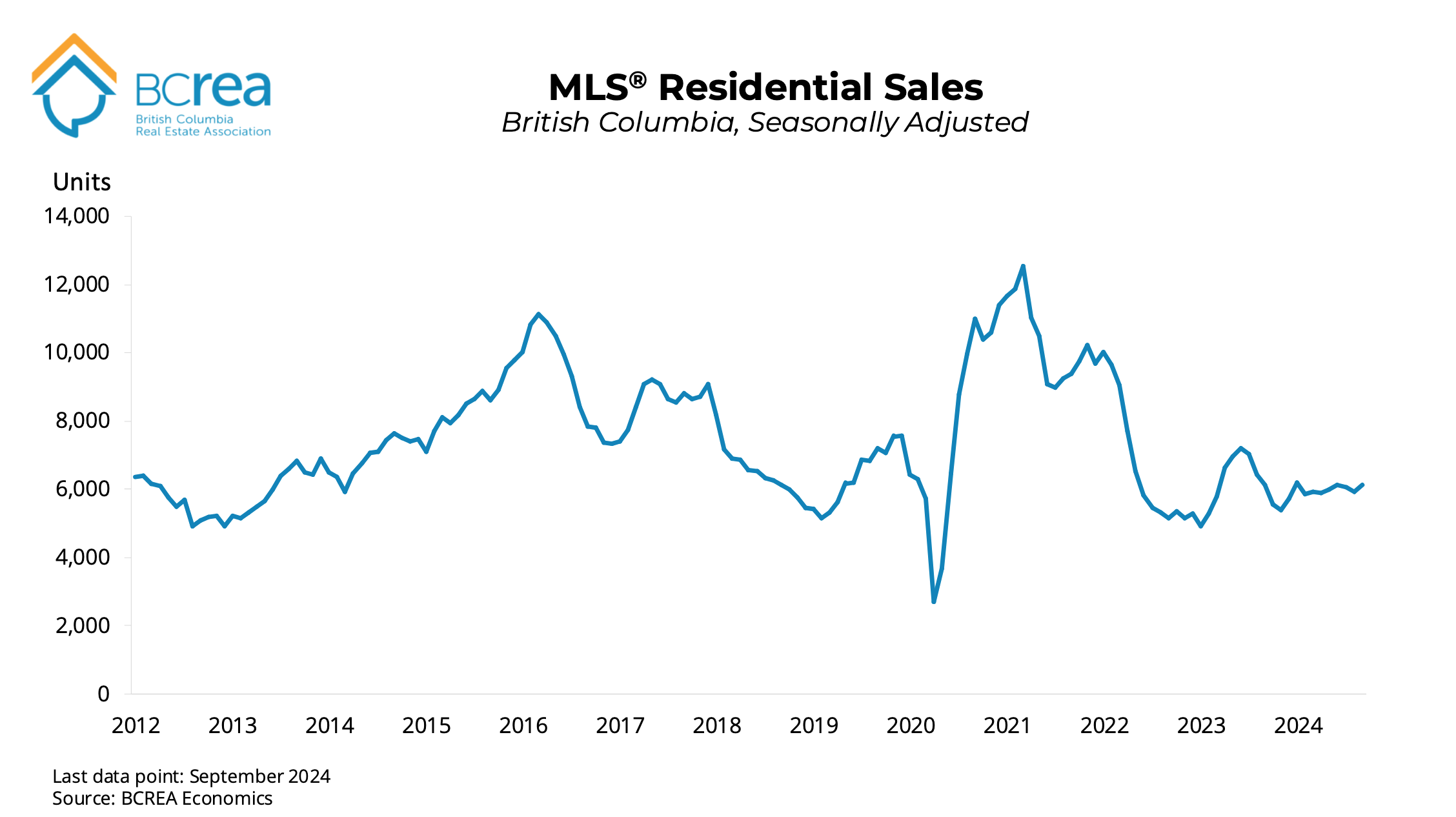

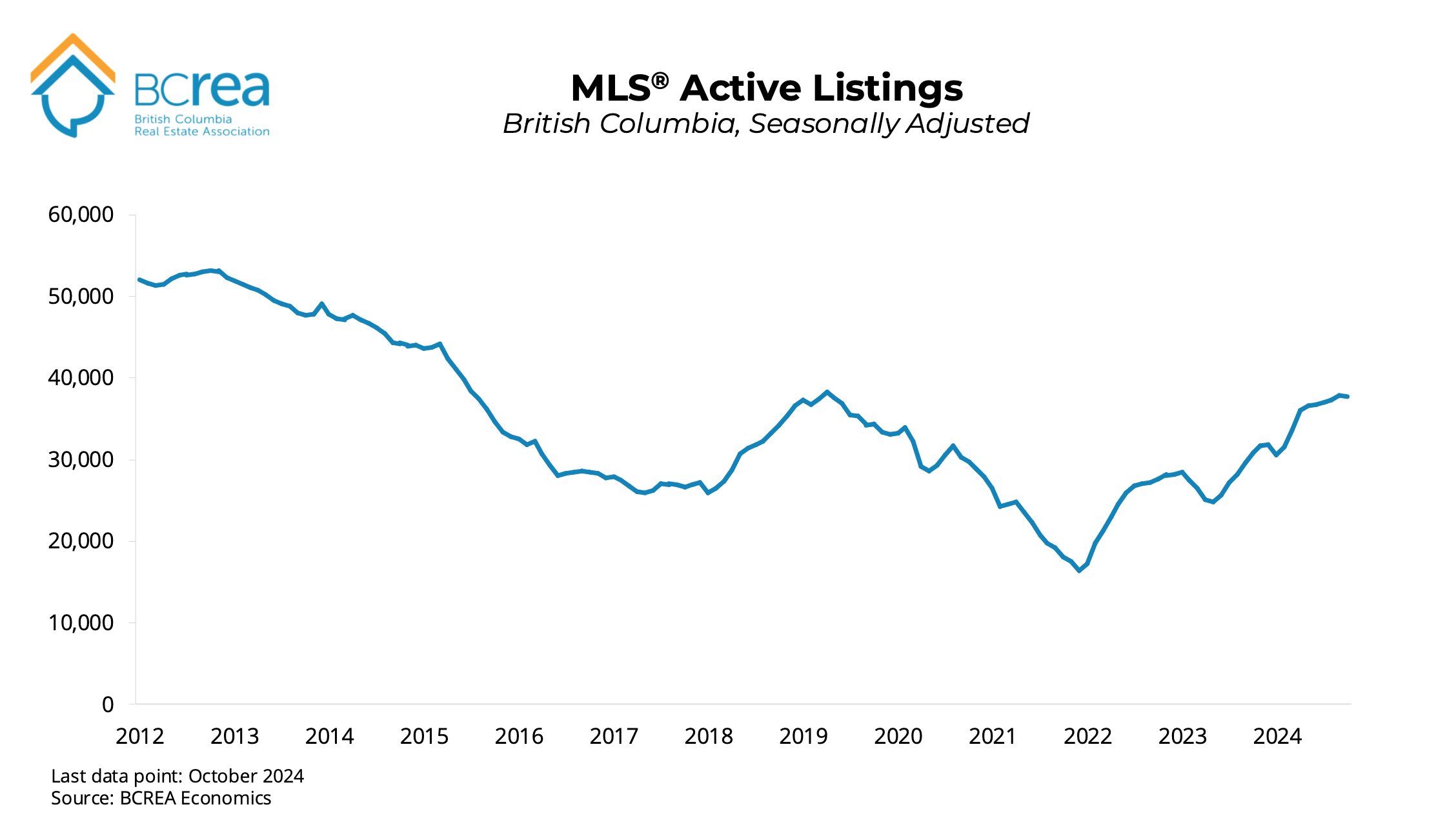

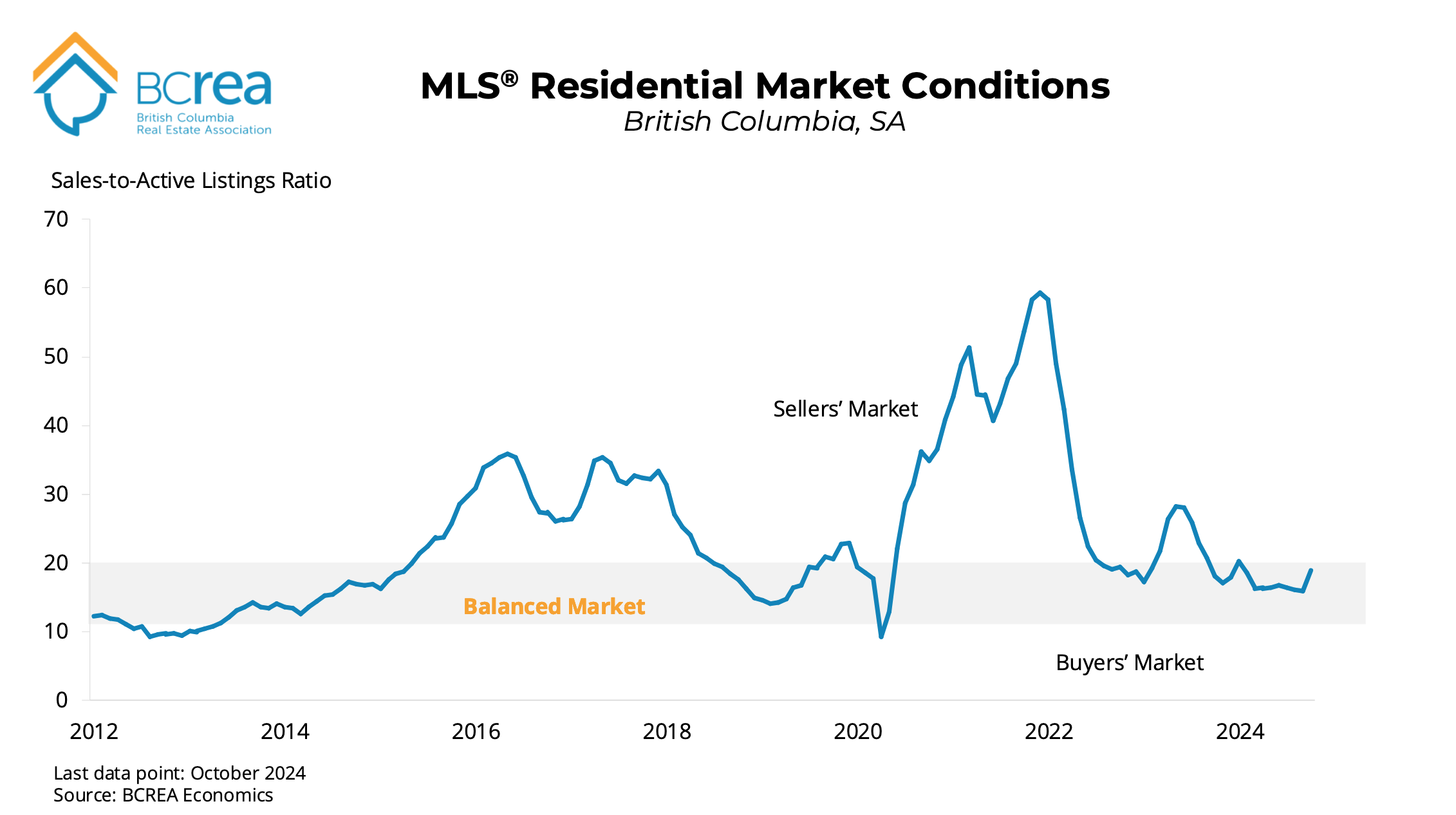

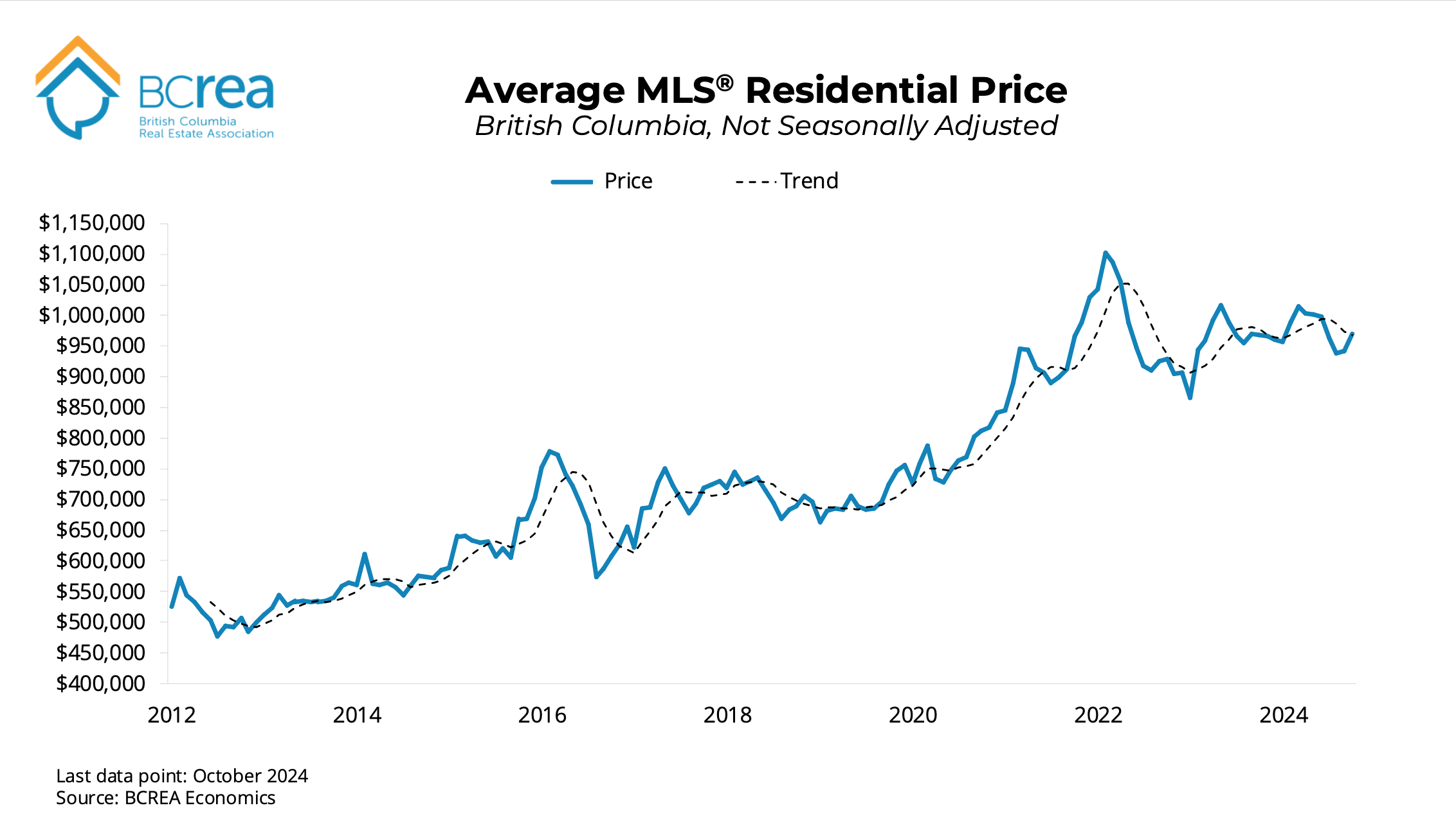

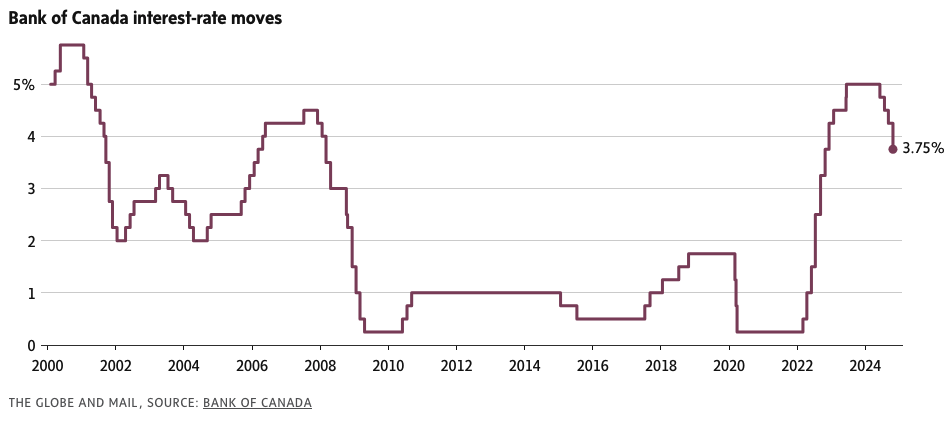

As interest rates have been coming down for the first time in four years, a long-awaited recovery in the real estate market has been expected but slow to materialize. October 2024 emerged as a pivotal month for British Columbia's real estate market, with significant signs of recovery and renewed activity across the province.