Market Conditions - October 2024

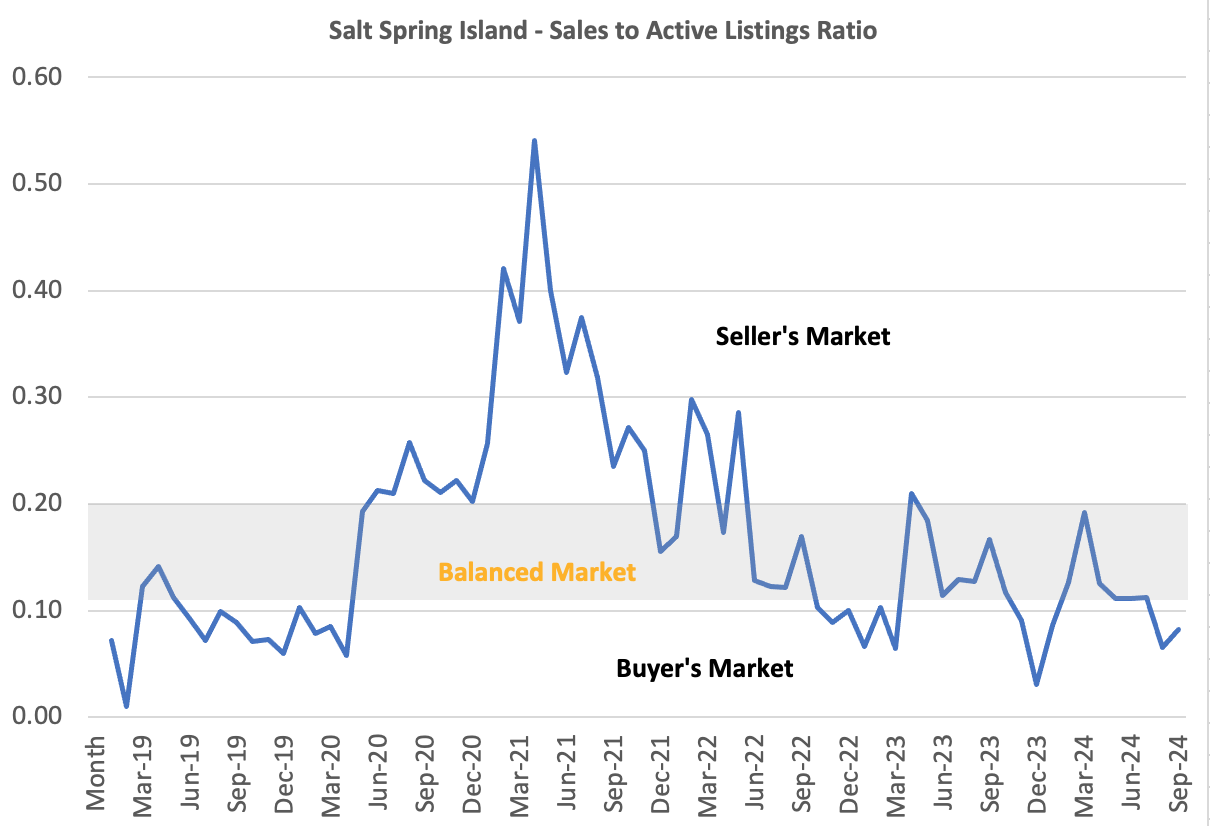

Salt Spring Island: A Buyer’s Market

The fall real estate market is upon us and September data reveals increased regional variability across BC. The increased regional variability calls for a closer look at what’s happening in our region specifically. Given the small market on Salt Spring Island, it is difficult to draw robust conclusions from Salt Spring data alone. Chance fluctuations have a large impact on patterns in small communities such as ours. Keeping that in mind, Salt Spring Island’s real estate market shows patterns that are consistent with the province overall. However, a key difference is that while BC’s market is still considered to be in balanced territory (though leaning towards a buyer’s market), Salt Spring now appears to have entered a buyer’s market. This means that buyers may find a greater selection, more accessible pricing, and increased negotiating power.

Enlarge Graph

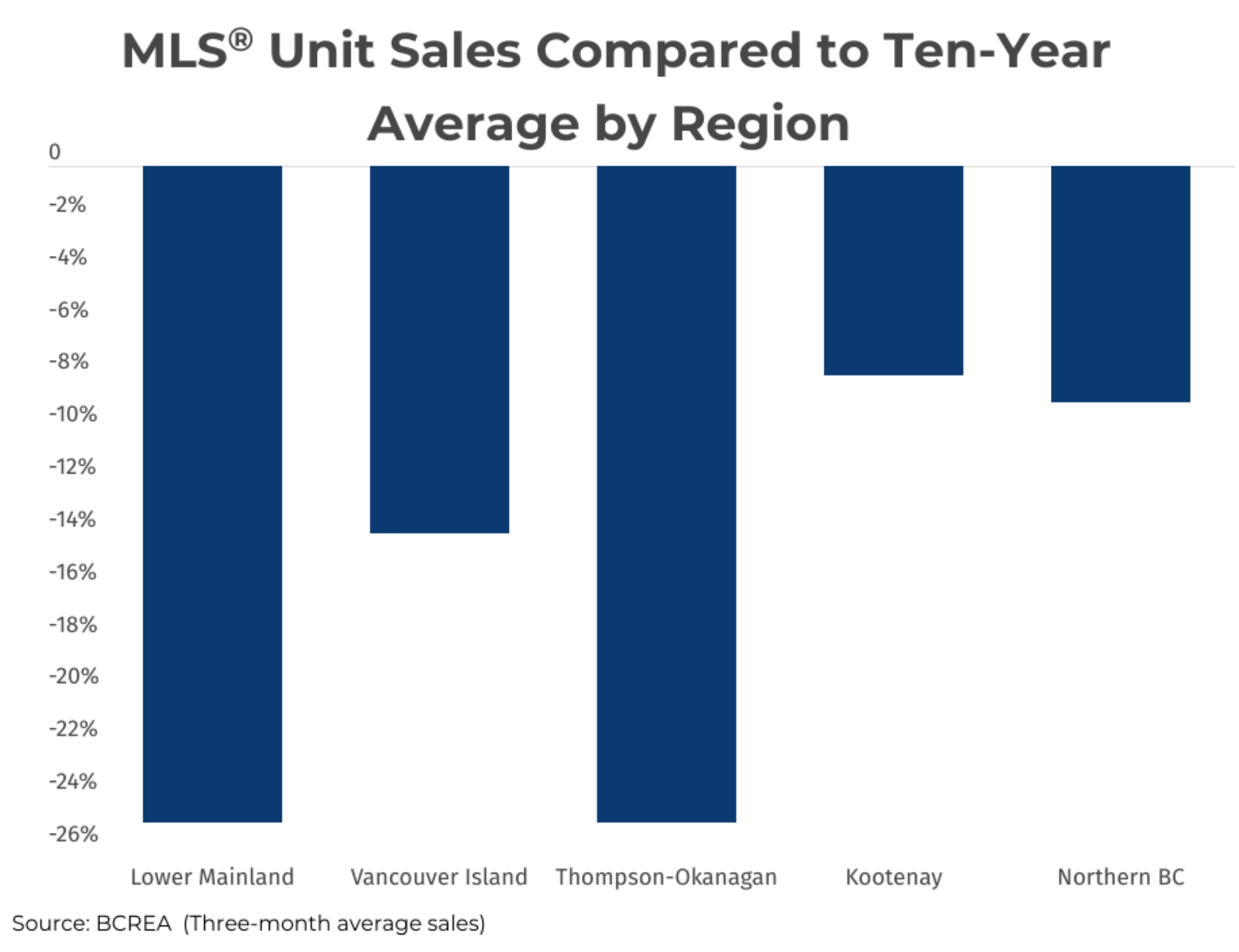

Regional Variability in BC

In the Lower Mainland and the Thompson-Okanagan regions, sales are down about 25% compared to the 10-year average. In contrast, Vancouver Island (including the Gulf Islands) has seen a smaller decline of about 15%, with Kootenay and Northern BC experiencing even milder drops.

Enlarge Graph

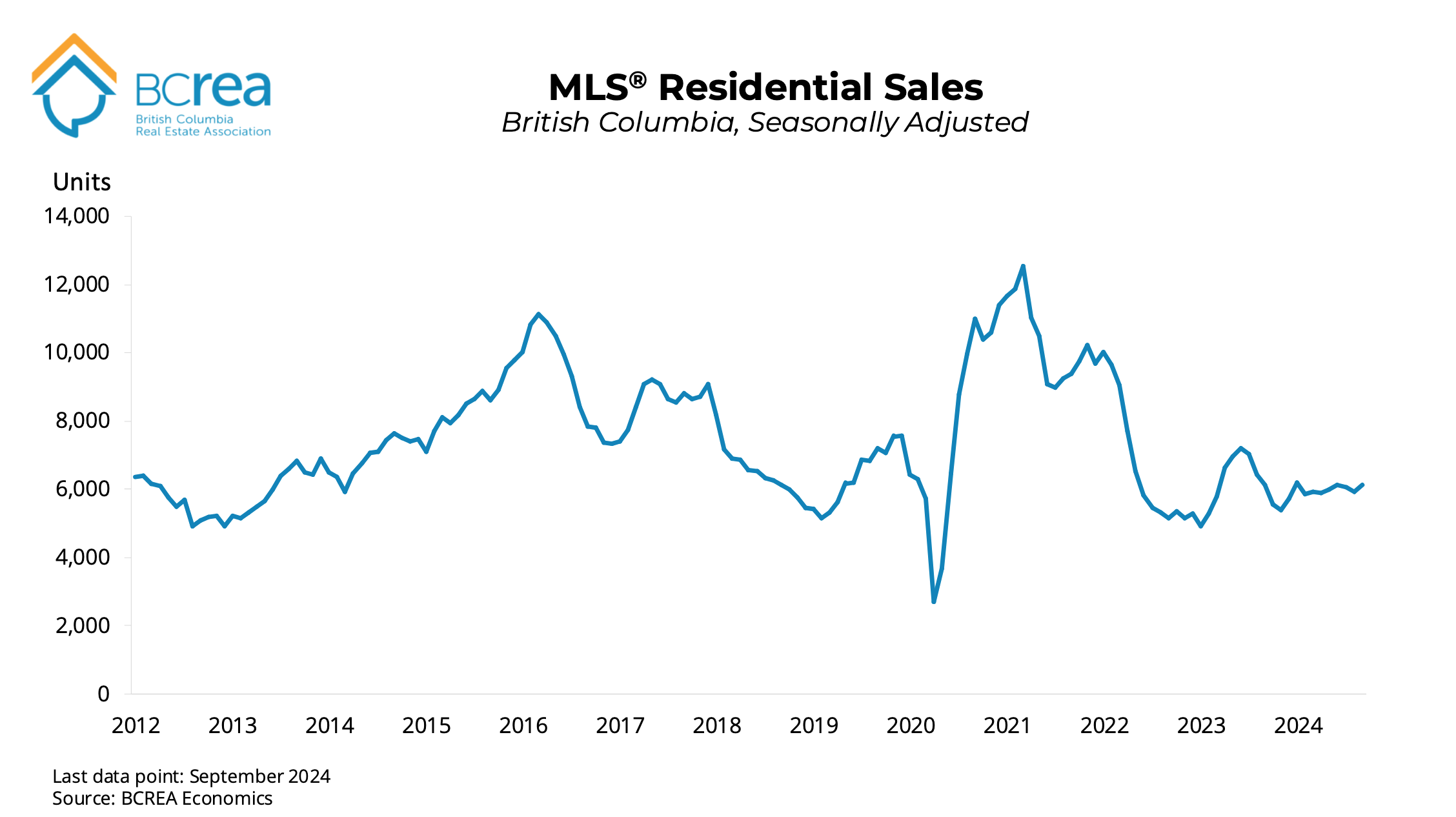

Fall Market Still Slow

September is typically a month when we see an increase in home sales. With the Bank of Canada’s three recent policy interest rate cuts, many expected a stronger real estate market this September. However, BC home sales have remained flat compared to both last month and last year, and they are still well below the 10-year average.

In September, inventory continued to accumulate, and average home prices remained down (2.8%) compared to the same time last year. This suggests that the cumulative 0.75% reduction in the policy interest rate from June to September has not yet led to the recovery anticipated in the BC real estate market.

Enlarge Graph

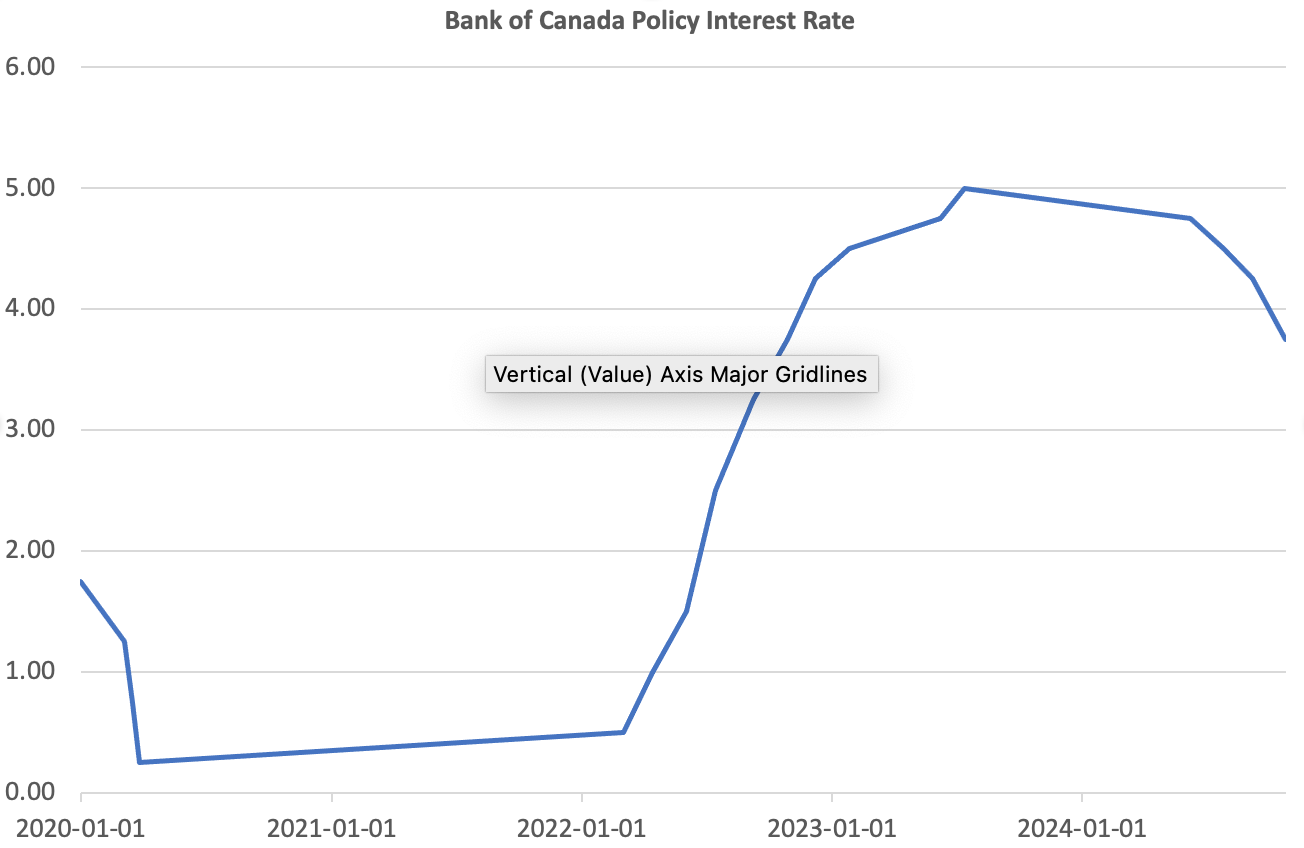

Bank of Canada’s Latest Move

On October 23rd, the Bank of Canada announced a 0.5% policy interest rate cut, its largest cut since the beginning of the pandemic in early 2020. This brings the policy interest rate to 3.75%.

So, what can we expect next? Economists believe this rate cut will stimulate demand, particularly as we head into the traditionally slower winter months. However, it may take a few months for the effects to show, with many predicting a more vigorous spring market in 2025.

Enlarge Graph

New Federal Mortgage Rules to Improve Affordability

In addition to the interest rate cuts, affordability is set to further improve thanks to new federal mortgage rules that will take effect on December 15. With these new rules, home buyers will be able make down payments of as little as 5% on properties worth up to $1.5M (increased from $1M) with insured mortgages. Additionally, 30-year amortizations will be available for all first-time home buyers and buyers of new builds, which will help reduce monthly mortgage payments. These changes are intended to make home ownership more accessible, especially for younger generations.

Opportunities for Buyers:

- Increased Inventory: With more homes on the market, buyers have a greater selection of properties to choose from.

- Price and Negotiation: In a buyer’s market, buyers will encounter more accessible pricing and sellers may be more willing to negotiate on price or include extras like repairs or upgrades.

- Favourable Mortgage Rates: The recent rate cuts and new mortgage rules improve affordability, making this a good time to secure a mortgage with favourable terms.

Opportunities for Sellers:

- Spring Preparation: While the current market may favour buyers, this is a great time for sellers to prepare their homes for a potentially stronger market in the spring of 2025. Making necessary repairs and upgrades now can help you list competitively when conditions improve.

- Unique Properties Still in Demand: Despite the buyer’s market, unique or well-maintained homes in desirable locations are still selling. Positioning your home properly with the right pricing strategy can make all the difference.

- Long-Term Investment: Even if prices have dipped, real estate on Salt Spring Island remains a valuable long-term investment. Sellers who don’t need to move immediately may benefit from waiting for the market to rebound, particularly if rates continue to drop.

Though the current market on Salt Spring Island is slower than expected, the combination of rate cuts, new mortgage rules, and a potential spring rebound offers a range of opportunities for both buyers and sellers. To gain a more comprehensive understanding of how the current market dynamics may impact your particular real estate goals, don't hesitate to reach out to me.

Gina Jacobsen, PhD

REALTOR®

(250)539-0828

ginajacobsen.com

Sources:

British Columbia Real Estate Association Economics

Victoria Real Estate Board MLS® STATISTICS

Canadian Real Estate Association

Department of Finance Canada

Bank of Canada