Real Estate Market Conditions - Monthly Update

March and April 2025

Resilience amid economic uncertainty

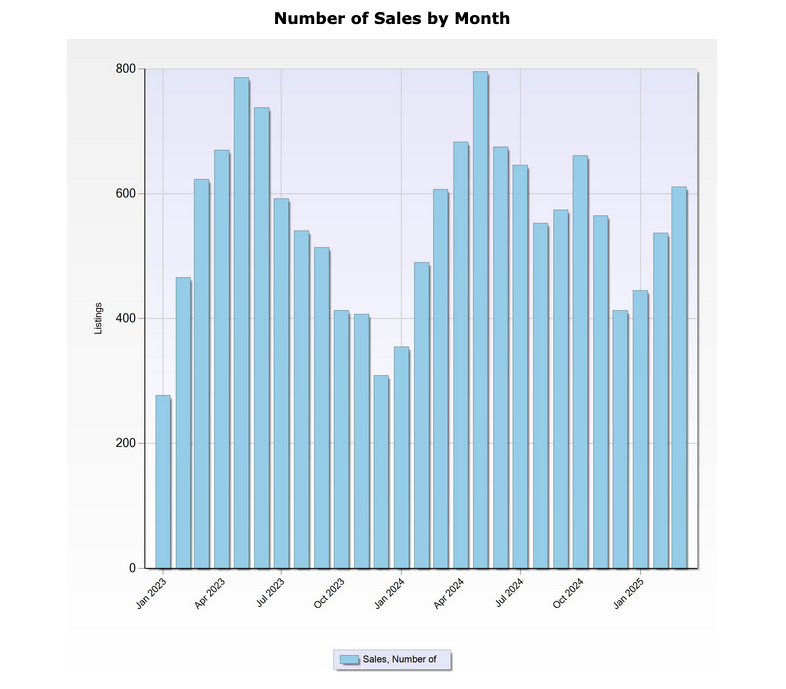

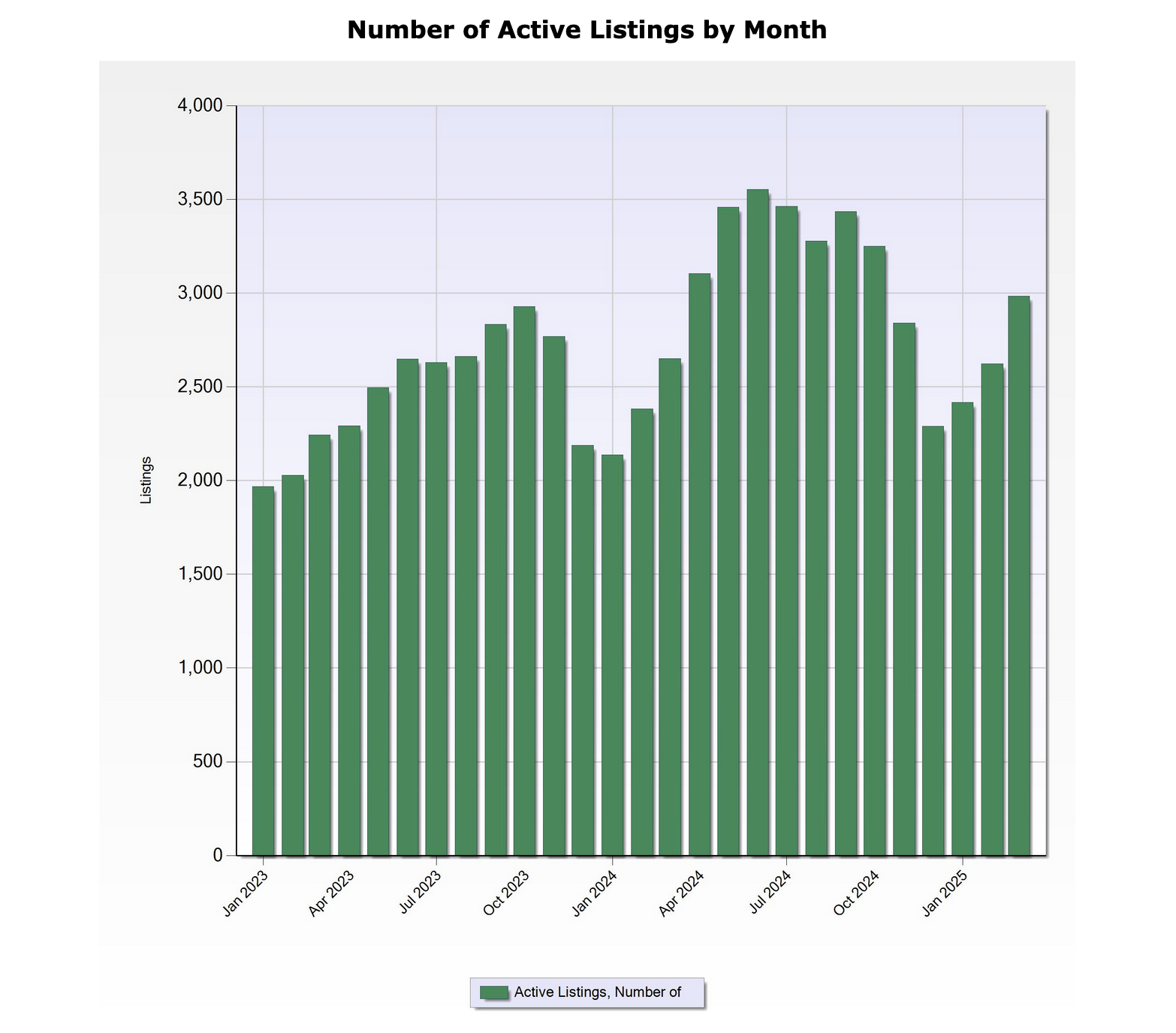

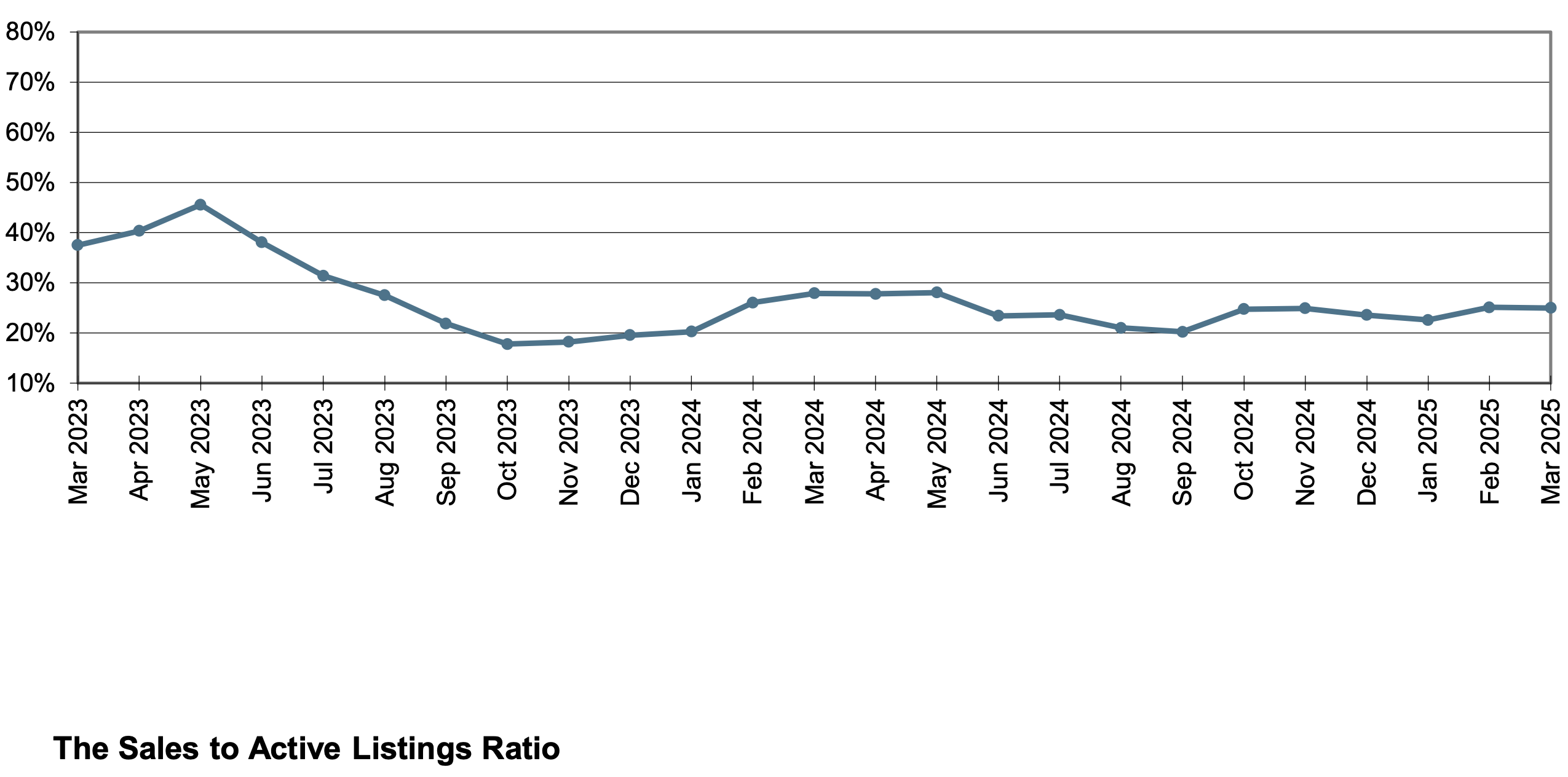

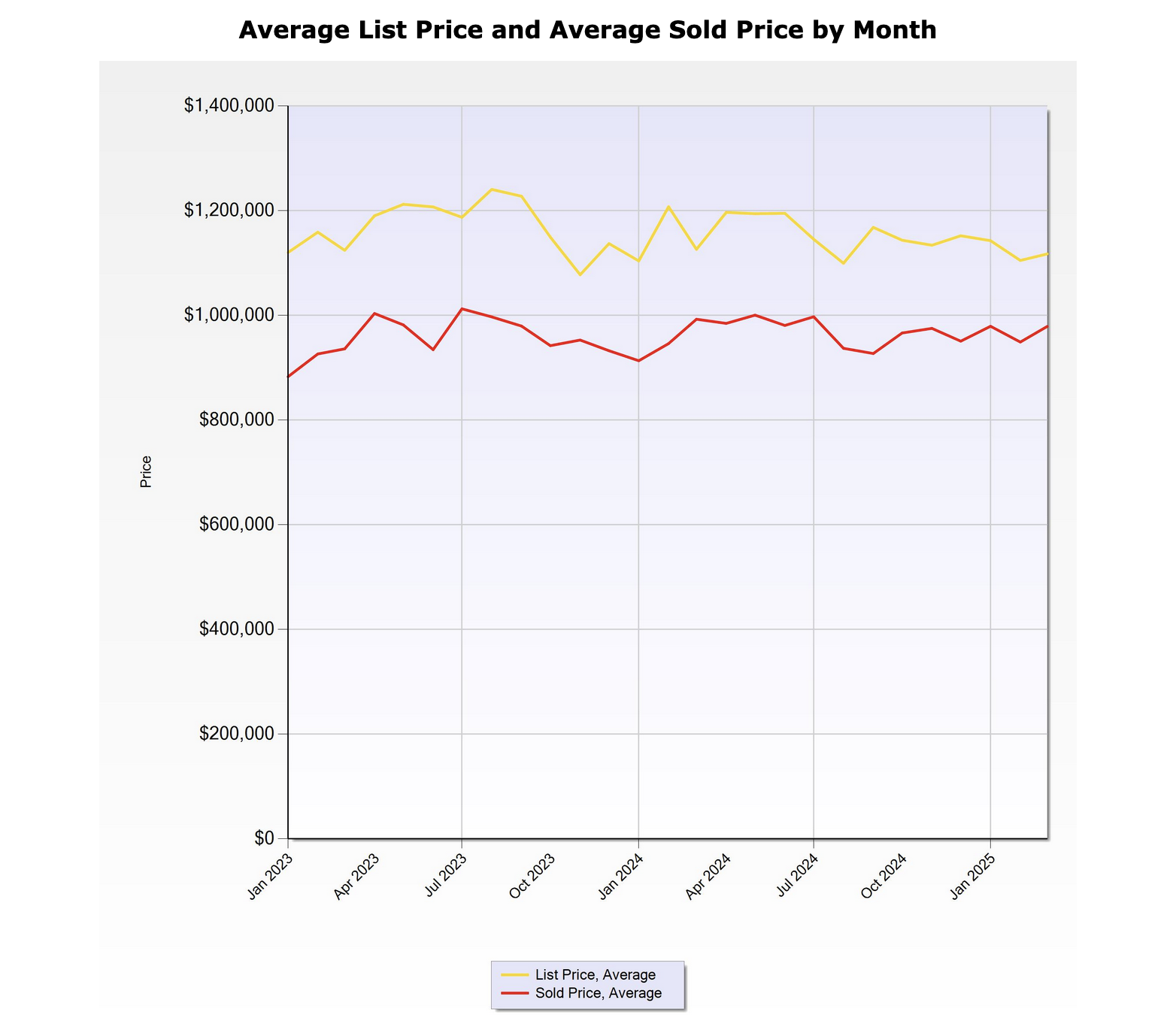

The early months of 2025 have unfolded against a backdrop of global economic uncertainty, yet our local market continued to show resilience. Both February and March saw steady growth in sales and inventory, reflecting a stable and balanced environment. On Salt Spring Island, these trends were evident, with the market appearing to be somewhat insulated and continuing to deliver strong opportunities for both buyers and sellers.